You may have heard about cryptocurrencies before but still don’t understand how they compare to the fiat currencies that you hold in your wallet or bank account. Someone may have bored you to tears about the technical details behind cryptocurrencies when you were actually more interested in what makes it so different from regular money, or as I’ll refer to in this article, fiat currencies.

Exchange of bonds and currency between the Fed and Treasury

The Treasury deposits the newly created currency in the different branches of the US government. The government then does some deficit spending on public works, social programs, and military operations. The government employees, contractors, and soldiers then deposit their pay in the banks.

Exchange of bonds and currency between the Fed and Treasury

The Treasury deposits the newly created currency in the different branches of the US government. The government then does some deficit spending on public works, social programs, and military operations. The government employees, contractors, and soldiers then deposit their pay in the banks.

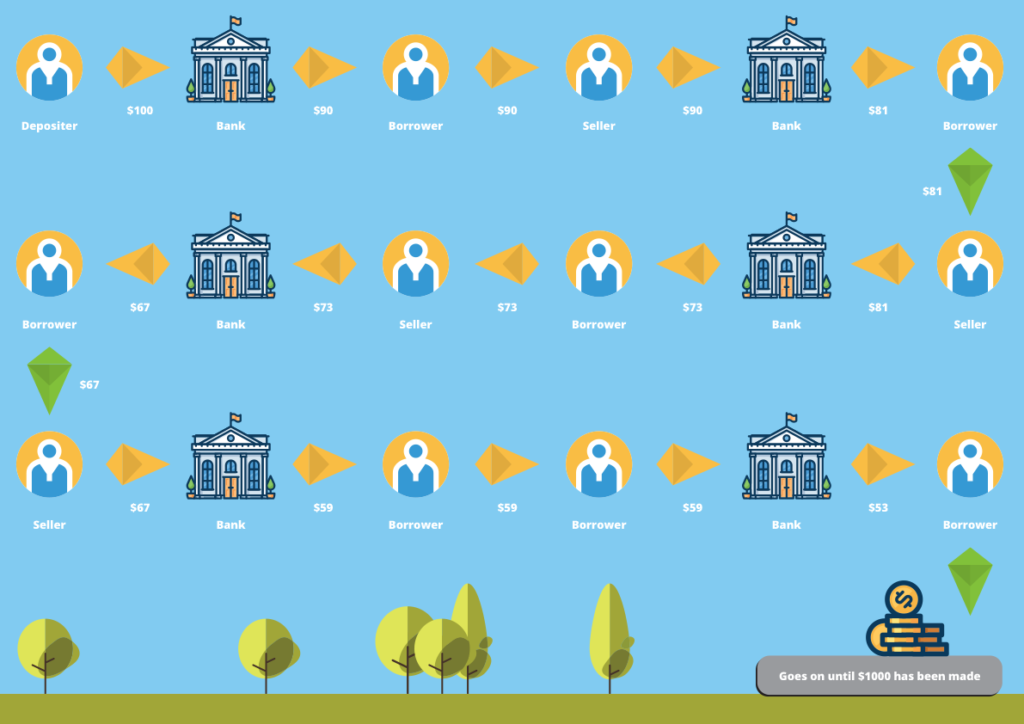

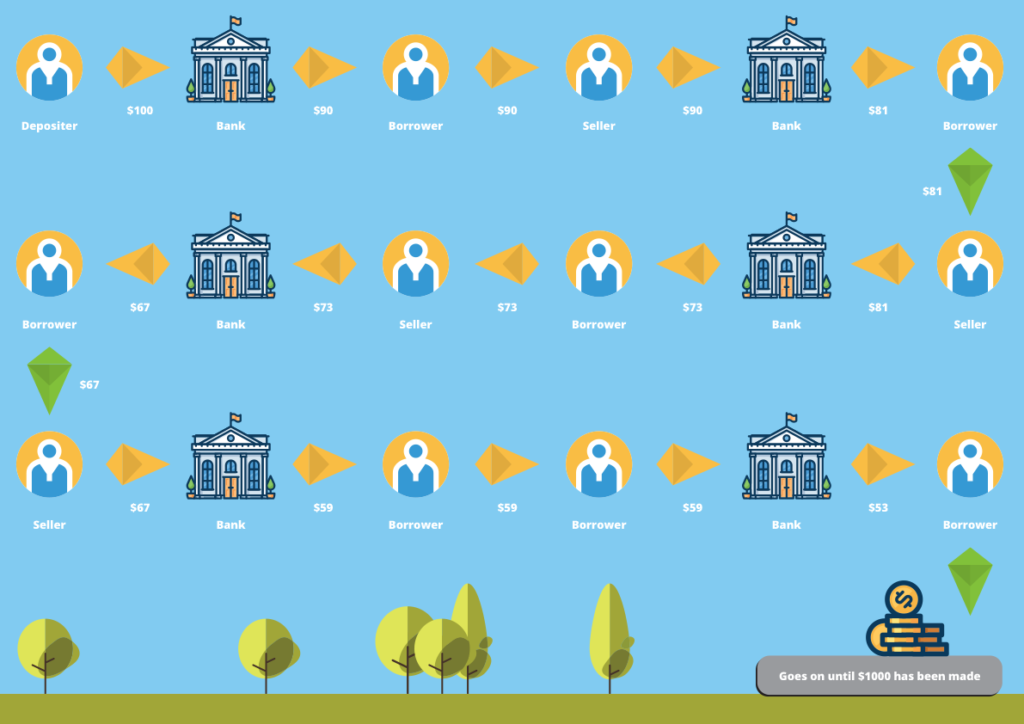

Fractional Reserve Lending (amounts have been rounded for simplicity)

This fractional reserve lending process leading to the creation of bank credit is where the vast majority our currency supply comes from. In fact, 92 to 96% of all currency in existence is created not by the government but by the banking system using this exact process.

People work for this currency supply by exchanging their labor for cash. Workers pay a part of this earned income as taxes to the Internal Revenue Service. The IRS then hands over the collected tax to the US Treasury where they pay off the principal and interest that was owed to bondholders, including the Fed. When the Fed receives payment for the bond’s principal and interest, the debt is extinguished and the currency received is removed from circulation. The Fed essentially regulates the currency supply in the purchase and sale of bonds.

If all of that was way too confusing to understand, don’t despair; this configuration is not intuitive by any stretch of the imagination. Now that we have a somewhat better understanding of how fiat currency is created and managed, let’s take a look at how bitcoins are made.

Fractional Reserve Lending (amounts have been rounded for simplicity)

This fractional reserve lending process leading to the creation of bank credit is where the vast majority our currency supply comes from. In fact, 92 to 96% of all currency in existence is created not by the government but by the banking system using this exact process.

People work for this currency supply by exchanging their labor for cash. Workers pay a part of this earned income as taxes to the Internal Revenue Service. The IRS then hands over the collected tax to the US Treasury where they pay off the principal and interest that was owed to bondholders, including the Fed. When the Fed receives payment for the bond’s principal and interest, the debt is extinguished and the currency received is removed from circulation. The Fed essentially regulates the currency supply in the purchase and sale of bonds.

If all of that was way too confusing to understand, don’t despair; this configuration is not intuitive by any stretch of the imagination. Now that we have a somewhat better understanding of how fiat currency is created and managed, let’s take a look at how bitcoins are made.

What is fiat (aka “real money”)?

Fiat currencies are usually issued by the central banks of each country around the world. Some governments may issue fiat currencies directly but most opt to issue them indirectly through their central bank which operates independently from the government. Central banks are independently run so that politics do not interfere with monetary policy. For example, the US President can’t just tell the Federal Reserve (or the Fed), the central bank of the United States, to decrease interest rates so that the economy looks better under his watch. Cryptocurrencies, on the other hand, do not have a centralized authority like the Fed to set monetary policy and issue new currency. Cryptocurrencies are managed by open-source software code that is very precise in the management of the cryptocurrency supply. Users of the software that choose to partake in the protocol and join the network know the rules up front and can’t force changes in the code on other users just because they feel like it. We will approach the difference between cryptocurrencies and fiat currencies by using well-known examples from each camp. For cryptocurrencies, we will use the first and most famous cryptocurrency, Bitcoin. For fiat currencies, we will use the world reserve currency, the US dollar, or USD. We’ll dig into how new currency is made, circulated, and managed between Bitcoin and the USD.How fiat currency is created

Every modern society creates fiat currency in pretty much the same way. Governments engage in deficit spending when they spend more than what they collect in income from tax revenue. To finance deficit spending, the US Treasury borrows currency by issuing a bond. A bond is essentially an IOU*. The government borrows money from you today to pay you back the principal within a certain period, let’s say ten years plus interest. The principal and interest are essentially the national debt which is to be paid by taxpayers. To sell these bonds, the Treasury holds a bond auction where the largest banks in the world bid against each other to buy these bonds in order to make a profit from the interest. Once banks have bought the bonds, they have the right to sell some of these bonds at a profit to the Federal Reserve during what’s called an “open market operation”. The Federal Reserve pays for these bonds by writing a check against a zero balance account, as per the Boston Federal Reserve’s “Putting it Simply”: “When you or I write a check there must be sufficient funds in our account to cover the check, but when the Federal Reserve writes a check there is no bank deposit on which that check is drawn. When the Federal Reserve writes a check, it is creating money.” The Fed hands those checks to the banks and at that point, currency is created. The banks take some of that newly created currency to buy more bonds at the next treasury auction. It’s important to understand the checks written by the Fed are also essentially IOUs which can be exchanged for cash at a bank. In essence, the US Treasury and the Fed are exchanging IOUs with each other using the banks as middlemen: the Fed receives treasury bonds while the US Treasury receives currency from the banks, checks written by the Fed and exchanged for cash. This process repeats as much as necessary which causes a build up of bonds at the Fed and a build-up of currency at the Treasury. This process is where all paper currency comes from which the government calls base money or base currency. Exchange of bonds and currency between the Fed and Treasury

The Treasury deposits the newly created currency in the different branches of the US government. The government then does some deficit spending on public works, social programs, and military operations. The government employees, contractors, and soldiers then deposit their pay in the banks.

Exchange of bonds and currency between the Fed and Treasury

The Treasury deposits the newly created currency in the different branches of the US government. The government then does some deficit spending on public works, social programs, and military operations. The government employees, contractors, and soldiers then deposit their pay in the banks.

Fractional Reserve Lending

This is the moment where fractional reserve lending comes into play which you may have briefly heard about before during Economics 101. Essentially, this scheme allows the banks to reserve only a fraction of your deposit and loan the rest out. Reserve ratios vary but for our example, I’ll be using 10%. If you deposit $100 in your account, the bank can legally take $90 of your deposit and loan it out without your knowledge. The bank must hold $10 of your deposit in reserve, just in case you want to withdraw some of it. These reserves are called vault cash. But why do you see $100 in your bank statement when the bank loaned out $90 of it? That’s because the bank has left IOUs in your account called bank credit. If this part confuses you, here is an explanation of the process from the Federal Reserve Bank of New York, “I Bet You Thought”, p.19: “Commercial banks create checkbook money whenever they grant a loan, simply by adding new deposit dollars in accounts on their books in exchange for a borrower’s IOU.” Having understood and accepted that explanation, we now see $190 in circulation instead of just the original $100 that was deposited initially. People take out loans to pay for something, like a car or a house. So, let’s say a borrower takes the $90 that was lent to him by the bank from your account. The borrower then pays the seller of the item that $90. The seller then deposits that $90 into his bank account and his bank loans out 90% of that deposit, and leaves bank credits in its place, just as before. So now there’s $271 in circulation. This process repeats and repeats under a 10% reserve ratio until an initial deposit of $100 can create up to $1000 of bank credit all backed by $100 of vault cash, just 10%. But as previously mentioned, reserve ratios vary. On some deposits, it’s 10%, on others it’s 3%, and on some forms of deposit, the reserve requirements are 0%. The result is the expansion of the currency supply by the banks is far greater than this example would lead you to believe. Fractional Reserve Lending (amounts have been rounded for simplicity)

This fractional reserve lending process leading to the creation of bank credit is where the vast majority our currency supply comes from. In fact, 92 to 96% of all currency in existence is created not by the government but by the banking system using this exact process.

People work for this currency supply by exchanging their labor for cash. Workers pay a part of this earned income as taxes to the Internal Revenue Service. The IRS then hands over the collected tax to the US Treasury where they pay off the principal and interest that was owed to bondholders, including the Fed. When the Fed receives payment for the bond’s principal and interest, the debt is extinguished and the currency received is removed from circulation. The Fed essentially regulates the currency supply in the purchase and sale of bonds.

If all of that was way too confusing to understand, don’t despair; this configuration is not intuitive by any stretch of the imagination. Now that we have a somewhat better understanding of how fiat currency is created and managed, let’s take a look at how bitcoins are made.

Fractional Reserve Lending (amounts have been rounded for simplicity)

This fractional reserve lending process leading to the creation of bank credit is where the vast majority our currency supply comes from. In fact, 92 to 96% of all currency in existence is created not by the government but by the banking system using this exact process.

People work for this currency supply by exchanging their labor for cash. Workers pay a part of this earned income as taxes to the Internal Revenue Service. The IRS then hands over the collected tax to the US Treasury where they pay off the principal and interest that was owed to bondholders, including the Fed. When the Fed receives payment for the bond’s principal and interest, the debt is extinguished and the currency received is removed from circulation. The Fed essentially regulates the currency supply in the purchase and sale of bonds.

If all of that was way too confusing to understand, don’t despair; this configuration is not intuitive by any stretch of the imagination. Now that we have a somewhat better understanding of how fiat currency is created and managed, let’s take a look at how bitcoins are made.

How cryptocurrency is made

Unlike the USD, Bitcoin does not have a central bank or authority like the Federal Reserve to emit currency. There is no singular authority which determines monetary policy in the Bitcoin network. There are also no intermediaries such as banks. Instead, Bitcoin has a decentralized peer-to-peer network which consists of nodes, or computers, running a unified version of the Bitcoin software and maintaining a distributed ledger which keeps track of all the bitcoin transactions between users since the first block, called the genesis block. Whereas US dollars come into existence from the Fed and the banking system, bitcoins come into existence with the creation of each new block. The first transaction in every block, called the coinbase transaction, is a payment to the address of the miner who found the block. (I won’t get into the nitty-gritty of how the block is found but it essentially involves a cryptographic operation on the data contents of the block by continuously incrementing a number, called the nonce, to find a cryptographic hash result value that satisfies a difficulty requirement set by the network.) This payment is a combination of the reward and transaction fees of the block. When the Bitcoin network first started out, the reward was 50 BTC. The reward amount undergoes a halvening process every two years. As of 2019, this reward amount is now 12.5 BTC. The reward is the primary incentive for miners to find Bitcoin blocks and the only way new coins are minted into the Bitcoin economy. The Bitcoin protocol will dole out block rewards to miners up until the year 2140. After that point, miners will have to live solely on the transaction fees. If this minting process reminds you more of digging for gold rather than the printing presses of a central bank, you would be right in your intuition. The inventor of Bitcoin was designing a deflationary asset rather than an inflationary one such as fiat currencies like the US dollar. Essentially, new bitcoins enter the Bitcoin economy as the first transaction to the miner for each new block that was found. Compare that to the way US dollars are born when the government or private individuals take on debt.Consensus

In terms of consensus in regard to USD, the Federal Reserve as the centralized authority (with its 12 regional member banks) has complete control over monetary policy. The US government has some influence by having the President appoint someone as Chair of the Fed. Banks are also not completely subordinate to the will of the Fed since they can manage their own interest rates. But once all is said and done, all decision making is set by the central bank in terms of the nation’s financial future. It is very rare for the White House, Congress, or the commercial banks to repudiate the Fed. Even if they do, they essentially have very little influence over monetary policy set by the Fed. Under a decentralized network such as Bitcoin, it’s a bit different. Nodes have to come to a consensus on the state of the network since any random person can join with his machine. I alluded to this process earlier during the discovery of a block by a node. There are specific consensus rules in place by the protocol for verification of a valid block. Since the Bitcoin blockchain is public, we can easily inspect that the protocol is working by looking at each block and confirming each nonce independently. This is actually what occurs when a new participant joins the network, he downloads the blockchain and validates block by block before building more blocks on top of it. During software upgrades, the Bitcoin community undergoes healthy debate as to how to proceed. These upgrades are called soft and hard forks. Without going down another rabbit hole, just know that if there is disagreement in the community during a hard fork, the network can split into two which actually did occur during the infamous Bitcoin Cash hard fork back in August 2017. People were understandably upset about the market chaos and confusion that ensued but this is a consequence of the decentralized nature of cryptocurrencies.Summary

| USD | BTC | |

| Monetary policy | Federal Reserve | Decentralized p2p network |

| Creation of base currency | Purchase and sale of bonds | Mining |

| Fractional Reserve Lending | Yes | No |

| Monetary model | Inflationary | Deflationary |

| Currency limit | None | 21 million BTC |

| Hard forks | None | Bitcoin Cash, Bitcoin Gold |

| Leadership | Governor | None |

| Transparency | M3 data is hidden | Distributed ledger |